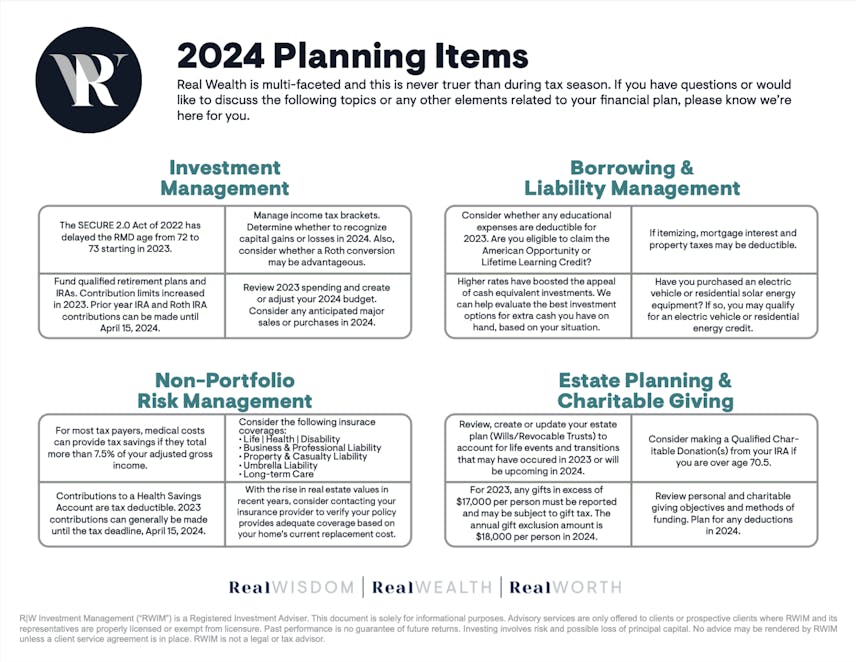

Real Wealth is multi-faceted and this is never truer than during tax season. If you have questions or would like to discuss the following topics or any other elements related to your financial plan, please know we’re here for you.

Investment Management

- The SECURE 2.0 Act of 2022 has delayed the RMD age from 72 to 73 starting in 2023.

- Manage income tax brackets. Determine whether to recognize capital gains or losses in 2024. Also, consider whether a Roth conversion may be advantageous.

- Fund qualifed retirement plans and IRAs. Contribution limits increased in 2023. Prior year IRA and Roth IRA contributions can be made until April 15, 2024.

- Review 2023 spending and create or adjust your 2024 budget. Consider any anticipated major sales or purchases in 2024.

Non-Portfolio Risk Management

- For most tax payers, medical costs can provide tax savings if they total more than 7.5% of your adjusted gross income.

- Consider the following insurance coverages:

- Life | Health | Disability

- Business & Professional Liability

- Property & Casualty Liability

- Umbrella Liability

- Long-term Care

- Contributions to a Health Savings Account are tax deductible. 2023 contributions can generally be made until the tax deadline, April 15, 2024.

- With the rise in real estate values in recent years, consider contacting your insurance provider to verify your policy provides adequate coverage based on your home’s current replacement cost.

Borrowing & Liability Management

- Consider whether any educational are deductible for 2023. Are you eligible to claim the American Opportunity or Lifetime Learning Credit?

- If itemizing, mortgage interest and property taxes may be deductible.

- Higher rates have boosted the appeal of cash equivalent investments. We can help evaluate the best investment options for extra cash you have on hand, based on your situation.

- Have you purchased an electric vehicle or residential solar energy equipment? If so, you may qualify for an electric vehicle or residential energy credit.

Estate Planning & Charitable Giving

- Review, create or update your estate plan (Wills/Revocable Trusts) to account for life events and transitions that may have occured in 2023 or will be upcoming in 2024.

- Consider making a Qualifed Charitable Donation(s) from your IRA if you are over age 70.5.

- For 2023, any gifts in excess of $17,000 per person must be reported and may be subject to gift tax. The annual gift exclusion amount is $18,000 per person in 2024.

- Review personal and charitable giving objectives and methods of funding. Plan for any deductions in 2024.

R|W Investment Management (“RWIM”) is a Registered Investment Adviser. This document is solely for informational purposes. Advisory services are only offered to clients or prospective clients where RWIM and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by RWIM unless a client service agreement is in place. RWIM is not a legal or tax advisor.

Accessibility Statement

This website is run by R|W Investment Management. We strive to make our website as accessible as possible. If you would like to receive this content in a different way, please contact us toll-free at (844) 834-7500.