This report features world capital market performance and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and bond asset classes in the US and international markets.

Table of Contents

RW Investment Management, LLC dba R|W Investment Management (“RWIM”) is a Registered Investment Adviser. This document is solely for informational purposes. Advisory services are only offered to clients or prospective clients where RWIM and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by RWIM unless a client service agreement is in place. RWIM is not a legal or tax advisor.

Reality Meets Expectation for the Mag 7

SECOND QUARTER 2024

Wes Crill, PhD, Senior Investment Director and Vice President, Dimensional Fund Advisors

It is unlikely any stock has an expected return of 100% per year. That seems too high to be the cost of equity capital for a company, and it’s doubtful anyone would sell a stock with an expected return 10 times the historical stock market return.Footnote 1 A realized return that big likely means the company surprised investors in a good way.

The Magnificent 7 stocks returned on average more than 111% in 2023, exceeding the S&P 500 Index by over 85 percentage points. While it’s hard to say what cash flow expectations were built into their stock prices, comparing analyst earnings estimates to actual earnings suggests these companies exceeded expectations for the year. All seven reported earnings exceeding average forecasts. For example, Nvidia posted an earnings per share 37.4% higher than the average analyst expectation. Contrast this with 2022, when five of the seven companies’ earnings fell short of analyst expectations. The average Magnificent 7 stock return that year trailed the S&P 500 Index by 28 percentage points.

Expecting Mag 7 out performance to continue is to bet on these companies further exceeding the market’s expectations. Simply meeting expectations may result in returns more in line with the market, consistent with the history of top US stocks.

SURPRISE, SURPRISE : Magnificent 7 actual vs. analyst forecast earnings pershare, 2022-2023

| 2022 | 2023 | |||||

| Analyst Forecast | Actual | Difference | Analyst Forecast | Actual | Difference | |

|---|---|---|---|---|---|---|

| NVDA | $3.77 | $1.74 | -53.8% ▼ | $8.69 | $11.94 | 37.4% ▲ |

| AAPL | $6.06 | $6.10 | 0.7% ▲ | $5.95 | $6.13 | 3.0% ▲ |

| TSLA | $3.73 | $3.63 | -2.7% ▼ | $3.61 | $4.30 | 19.2% ▲ |

| MSFT | $9.14 | $9.64 | 5.5% ▲ | $9.35 | $9.68 | 3.6% ▲ |

| AMZN | $1.09 | -$0.27 | -125.0% ▼ | $1.93 | $2.89 | 49.7% ▲ |

| GOOGL | $5.04 | $4.55 | -9.6% ▼ | $5.21 | $5.81 | 11.4% ▲ |

| META | $10.49 | $8.59 | -18.2% ▼ | $11.33 | $14.90 | 31.5% ▲ |

1. The S&P 500 Index had an annualized return of 10.3% from January 1926 to December 2023. S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. See next section for important disclosure. Back to ↩

Past performance is no guarantee of future results.

Disclosures

The information in this material is intended for the recipient’s background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness. Information and opinions presented in this material have been obtained or derived from sources believed by Dimensional to be reliable, and Dimensional has reasonable grounds to believe that all factual information herein is true as at the date of this material. It does not constitute investment advice, a recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Before acting on any information in this document, you should consider whether it is appropriate for your particular circumstances and, if appropriate, seek professional advice. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations.

Unauthorized reproduction or transmission of this material is strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein. This material is not directed at any person in any jurisdiction where the availability of this material is prohibited or would subject Dimensional or its products or services to any registration, licensing, or other such legal requirements within the jurisdiction.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd., Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

RISKS

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Investment products: • Not FDIC Insured • Not Bank Guaranteed • May Lose Value

Dimensional Fund Advisors does not have any bank affiliates.

Quarterly Market Summary

INDEX RETURNS

| US Stock Market |

International Developed Stocks |

Emerging Markets Stocks |

Global Real Estate |

US Bond Market |

Global Bond Market ex US |

|

|---|---|---|---|---|---|---|

| Q2 2024 | STOCKS | BONDS | ||||

| 3.22% ▲ |

-0.60% ▼ |

5.00% ▲ |

-1.48% ▼ |

0.07% ▲ |

0.11% ▲ |

|

| Since Jan. 2001 | ||||||

| Average Quarterly Return |

2.4% | 1.6% | 2.5% | 2.2% | 0.9% | 0.9% |

| Best Quarter |

22.0% 2020 Q2 |

25.9% 2009 Q2 |

34.7% 2009 Q2 |

32.3% 2009 Q3 |

6.8% 2023 Q4 |

5.4% 2023 Q4 |

| Worst Quarter |

-22.8% 2008 Q4 |

-23.3% 2020 Q1 |

-27.6% 2008 Q4 |

-36.1% 2008 Q4 |

-5.9% 2022 Q1 |

-4.1% 2022 Q1 |

Long-Term Market Summary

INDEX RETURNS AS OF JUNE 30, 2024

| US Stock Market |

International Developed Stocks |

Emerging Markets Stocks |

Global Real Estate |

US Bond Market |

Global Bond Market ex US |

|

|---|---|---|---|---|---|---|

| 1 Year | STOCKS | BONDS | ||||

| 23.13% ▲ |

11.22% ▲ |

12.55% ▲ |

5.10% ▲ |

2.63% ▲ |

5.26% ▲ |

|

| 5 Years | ||||||

| 14.14% ▲ |

6.55% ▲ |

3.10% ▲ |

0.65% ▲ |

-0.23% ▼ |

0.51% ▲ |

|

| 10 Years | ||||||

| 12.15% ▲ |

4.27% ▲ |

2.79% ▲ |

2.94% ▲ |

1.35% ▲ |

2.45% ▲ |

|

Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Market segment (index representation) as follows: US Stock Market (Russell 3000 Index), International Developed Stocks (MSCI World ex USA Index [net dividends]), Emerging Markets (MSCI Emerging Markets Index [net dividends]), Global Real Estate (S&P Global REIT Index [net dividends]), US Bond Market (Bloomberg US Aggregate Bond Index), and Global Bond Market ex US (Bloomberg Global Aggregate ex-USD Bond Index [hedged to USD]). S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2024, all rights reserved. Bloomberg data provided by Bloomberg

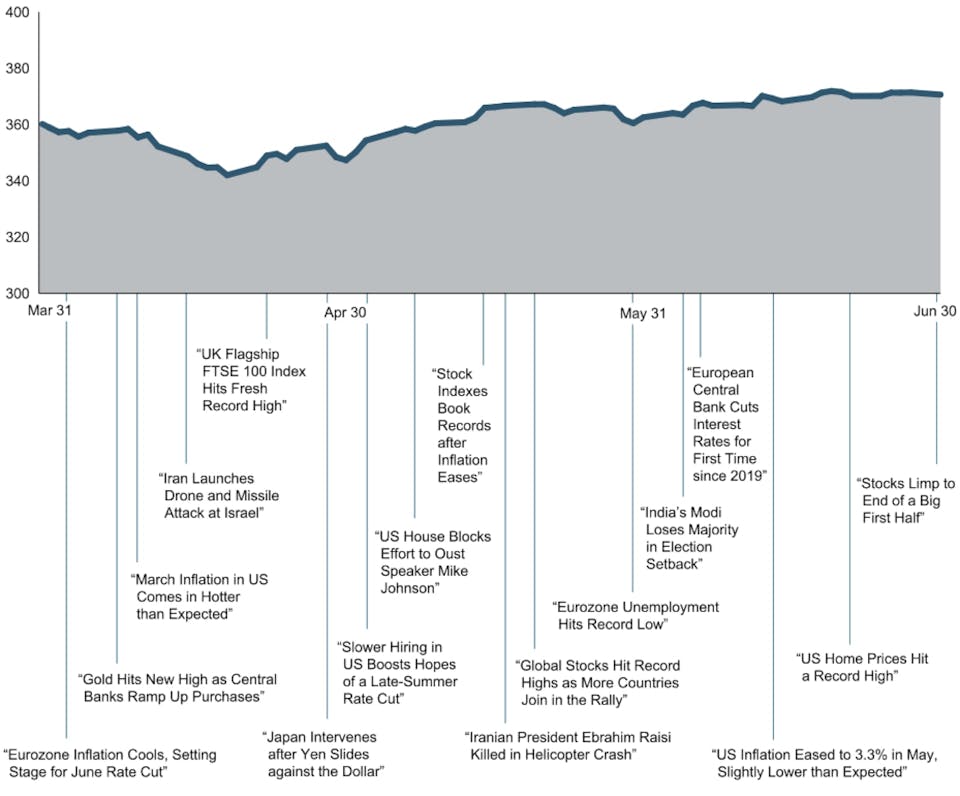

World Stock Market Performance

MSCI ALL COUNTRY WORLD INDEX WITH SELECTED HEADLINES FROM Q2 2024

1 Year (Q3 2023 - Q2 2024)

Q2 2024

Graph Source: MSCI ACWI Index (net dividends). MSCI data © MSCI 2024, all rights reserved. Index level based at 100 starting January 2000. It is not possible to invest directly in an index. Performance does not reflect the expenses associate with management of an actual portfolio. Past performance is not a guarantee of future results.

MSCI ALL COUNTRY WORLD INDEX WITH SELECTED HEADLINES FROM PAST 12 MONTHS

Long term 2000 to Q2 2024

Short term Q3 2023 to Q2 2024

These headlines are not offered to explain market returns. Instead, they serve as a reminder that investors should view daily events from a long-term perspective and avoid making investment decisions based solely on the news.

Graph Source: MSCI ACWI Index (net dividends). MSCI data © MSCI 2024, all rights reserved. Index level based at 100 starting January 2000. It is not possible to invest directly in an index. Performance does not reflect the expenses associate with management of an actual portfolio. Past performance is not a guarantee of future results.

US Stocks

SECOND QUARTER 2024 INDEX RETURNS

The US equity market posted positive returns for the quarter and outperformed non-US developed markets, but underperformed emerging markets.

Value underperformed growth.

Small caps underperformed large caps.

REIT indices underperformed equity market indices.

World Market Capitalization — US

$52.1 trillion

Ranked Returns (%)

Period Returns (%)

| Annualized | ||||||

|---|---|---|---|---|---|---|

| Asset Class | QTR | YTD | 1 Year | 3 Years | 5 Years | 10 Years |

| Large Growth | 8.33 | 20.70 | 33.48 | 11.28 | 19.34 | 16.33 |

| Large Cap | 3.57 | 14.24 | 23.88 | 8.74 | 14.61 | 12.51 |

| Marketwide | 3.22 | 13.56 | 23.13 | 8.05 | 14.14 | 12.15 |

| Large Value | -2.17 | 6.62 | 13.06 | 5.52 | 9.01 | 8.23 |

| Small Growth | -2.92 | 4.44 | 9.14 | -4.86 | 6.17 | 7.39 |

| Small Cap | -3.28 | 1.73 | 10.06 | -2.58 | 6.94 | 7.00 |

| Small Value | -3.64 | -0.85 | 10.90 | -0.53 | 7.07 | 6.23 |

Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Market segment (index representation) as follows: Marketwide (Russell 3000 Index), Large Cap (Russell 1000 Index), Large Value (Russell 1000 Value Index), Large Growth (Russell 1000 Growth Index), Small Cap(Russell 2000 Index), Small Value (Russell 2000 Value Index), and Small Growth (Russell 2000 Growth Index). World Market Cap represented by Russell 3000 Index, MSCI World ex USA IMI Index, and MSCI EmergingMarkets IMI Index. Russell 3000 Index is used as the proxy for the US market. Dow Jones US Select REIT Index used as proxy for the US REIT market. MSCI data © MSCI 2024, all rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes.

International Developed Stocks

SECOND QUARTER 2024 INDEX RETURNS

Developed markets outside of the US posted negative returns for the quarter and under performed both US and emerging markets.

Value outperformed growth.

Small caps underperformed large caps.

World Market Capitalization - International Developed

$21.4 trillion

Ranked Returns (%)

Period Returns (%)

| Annualized | ||||||

|---|---|---|---|---|---|---|

| Asset Class | QTR | YTD | 1 Year | 3 Years | 5 Years | 10 Years |

| Value | -0.17 | 4.03 | 13.17 | 5.45 | 6.21 | 3.06 |

| Large Cap | -0.60 | 4.96 | 11.22 | 2.82 | 6.55 | 4.27 |

| Growth | -0.94 | 5.91 | 9.36 | 0.02 | 6.46 | 5.23 |

| Small Cap | -1.56 | 0.98 | 7.80 | -2.98 | 4.69 | 4.04 |

Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Market segment (index representation) as follows: Large Cap (MSCI World ex USA Index), Small Cap (MSCI World ex USA Small Cap Index), Value (MSCI World ex USA Value Index), and Growth (MSCI World ex USAGrowth Index). All index returns are net of withholding tax on dividends. World Market Cap represented by Russell 3000 Index, MSCI World ex USA IMI Index, and MSCI Emerging Markets IMI Index. MSCI World ex USA IMI Index is used as the proxy for the International Developed market. MSCI data © MSCI 2024, all rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes.

Emerging Markets Stocks

SECOND QUARTER 2024 INDEX RETURNS

Emerging markets posted positive returns for the quarter and outperformed both US and non-US developed markets.

Value outperformed growth.

Small caps outperformed large caps.

World Market Capitalization - Emerging Markets

$8.9 trillion

Ranked Returns (%)

Period Returns (%)

| Annualized | ||||||

|---|---|---|---|---|---|---|

| Asset Class | QTR | YTD | 1 Year | 3 Years | 5 Years | 10 Years |

| Small Cap | 5.93 | 7.04 | 20.04 | 2.54 | 9.99 | 5.15 |

| Value | 5.08 | 6.46 | 14.13 | -1.09 | 2.91 | 1.96 |

| Large Cap | 5.00 | 7.49 | 12.55 | -5.07 | 3.10 | 2.79 |

| Growth | 4.94 | 8.45 | 11.08 | -8.70 | 3.18 | 3.51 |

Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Market segment (index representation) as follows: Large Cap (MSCI Emerging Markets Index), Small Cap (MSCI Emerging Markets Small Cap Index), Value (MSCI Emerging Markets Value Index), and Growth (MSCI EmergingMarkets Growth Index). All index returns are net of withholding tax on dividends. World Market Cap represented by Russell 3000 Index, MSCI World ex USA IMI Index, and MSCI Emerging Markets IMI Index. MSCI EmergingMarkets IMI Index used as the proxy for the emerging market portion of the market. MSCI data © MSCI 2024, all rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes.

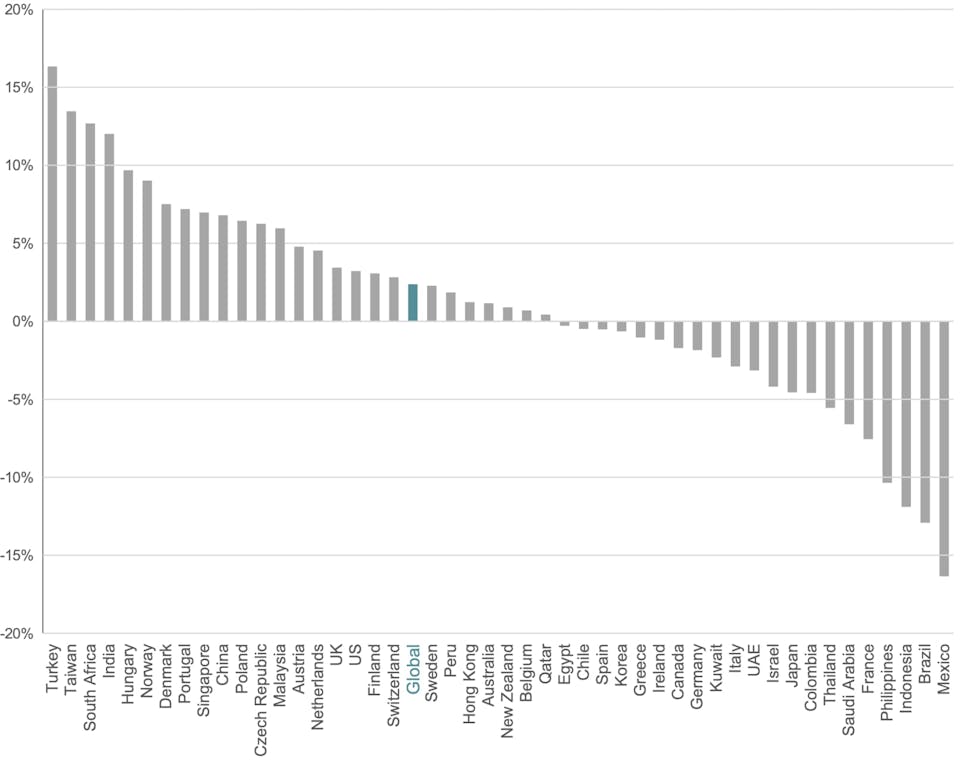

Country Returns

SECOND QUARTER 2024 INDEX RETURNS

Past performance is no guarantee of future results.

Country returns are the country component indices of the MSCI All Country World IMI Index for all countries except the United States, where the Russell 3000 Index is used instead. Global is the return of the MSCI All Country World IMI Index. MSCI index returns are net dividend. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. MSCI data © MSCI 2024, all rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes.

Real Estate Investment Trusts (REITs)

SECOND QUARTER 2024 INDEX RETURNS

US real estate investment trusts outperformed non-US REITs during the quarter.

Total Value of REIT Stocks

$416 billion 283 REITs (25 other countries)

$968 billion 102 REITS

Ranked Returns (%)

Period Returns (%)

| Annualized | ||||||

|---|---|---|---|---|---|---|

| Asset Class | QTR | YTD | 1 Year | 3 Years | 5 Years | 10 Years |

| US REITS | -0.16 | -0.55 | 7.15 | -0.14 | 2.78 | 5.17 |

| Global ex US REITS | -4.39 | -6.72 | 2.45 | -7.80 | -3.59 | -0.05 |

Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Number of REIT stocks and total value based on the two indices. All index returns are net of withholding tax on dividends. Total value of REIT stocks represented by Dow Jones US Select REIT Index and the S&P Global ex US REIT Index. Dow Jones US Select REIT Index used as proxy for the US market, and S&P Global ex US REIT Index used as proxy for the World ex US market. Dow Jones and S&P data © 2024 S&P Dow JonesIndices LLC, a division of S&P Global. All rights reserved.

Commodities

SECOND QUARTER 2024 INDEX RETURNS

The Bloomberg Commodity Total Return Index returned +2.89% for the second quarter of 2024.

Coffee and Zinc were the best performers, returning +20.96% and +18.78% during the quarter, respectively. Cotton and Lean Hogs were the worst performers, returning -21.81% and -11.74% during the quarter, respectively.

| Asset Class | Commodities | |

|---|---|---|

| QTR | 2.89 | |

| YTD | 5.14 | |

| 1 Year | 5.00 | |

| 3 Years | 5.65 | Annualized |

| 5 Years | 7.25 | |

| 10 Years | -1.29 | |

Ranked Returns (%)

Past performance is not a guarantee of future results. Index is not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Commodities returns represent the return of the Bloomberg Commodity Total Return Index. Individual commodities are sub-index values of the Bloomberg Commodity Total Return Index. Data provided by Bloomberg.

Fixed Income

SECOND QUARTER 2024 INDEX RETURNS

Interest rates generally increased in the US Treasury market for the quarter.

On the short end of the yield curve, the 1-Month US Treasury Bill yield decreased basis points (bps) to +5.47%, while the 1-Year US Treasury Bill yield increased 6bps to +5.09%. The yield on the 2-Year US Treasury Note increased 12 bps to +4.71%.

The yield on the 5-Year US Treasury Note increased 12 bps to +4.33%. The yield on the 10-Year US Treasury Note increased 16bps to +4.36%. The yield on the 30-Year US Treasury Bond increased 17 bps to +4.51%.

In terms of total returns, short-term US treasury bonds returned +0.77% while intermediate-term US treasury bonds returned +0.58%. Short-term corporate bonds returned +0.96% and intermediate-term corporate bonds returned +0.74%.Footnote 1

The total returns for short- and intermediate-term municipal bonds were +0.35% and -0.92%, respectively. Within the municipal fixed income market, general obligation bonds returned -0.30% while revenue bonds returned +0.07%.Footnote 2

US Treasury Yield Curve (%)

Bond Yield Across Issuers (%)

Period Returns (%)

| Annualized | ||||||

|---|---|---|---|---|---|---|

| Asset Class | QTR | YTD | 1 Year | 3 Years | 5 Years | 10 Years |

| ICE BofA US 3-Month Treasury Bill Index | 1.32 | 2.63 | 5.40 | 3.03 | 2.16 | 1.51 |

| ICE BofA 1-Year US Treasury Note Index | 1.11 | 1.95 | 5.02 | 1.80 | 1.69 | 1.36 |

| Bloomberg U.S. High Yield Corporate Bond Index | 1.09 | 2.58 | 10.44 | 1.64 | 3.92 | 4.31 |

| FTSE World Government Bond Index 1-5 Years (hedged to USD) | 0.87 | 1.13 | 4.84 | 0.38 | 1.03 | 1.43 |

| Bloomberg U.S. TIPS Index | 0.79 | 0.70 | 2.71 | -1.33 | 2.07 | 1.91 |

| Bloomberg U.S. Aggregate Bond Index | 0.07 | -0.71 | 2.63 | -3.02 | -0.23 | 1.35 |

| Bloomberg Municipal Bond Index | -0.02 | -0.40 | 3.21 | -0.88 | 1.16 | 2.39 |

| FTSE World Government Bond Index 1-5 Years | -0.06 | -1.41 | 2.43 | -2.73 | -0.79 | -0.78 |

| Bloomberg U.S. Government Bond Index Long | -1.80 | -4.99 | -5.55 | -10.45 | -4.24 | 0.60 |

- Bloomberg US Treasury and US Corporate Bond Indices. Back to ↩

- Bloomberg Municipal Bond Index. Back to ↩

One basis point (bps) equals 0.01%. Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Yield curve data from Federal Reserve. State and local bonds, and the Yield to Worst are from the S&P National AMT-Free Municipal Bond Index. AAA-AA Corporates represent the ICE BofA US Corporates, AA-AAA rated. A-BBBCorporates represent the ICE BofA Corporates, BBB-A rated. Bloomberg data provided by Bloomberg. US long-term bonds, bills, inflation, and fixed income factor data © Stocks, Bonds, Bills, and Inflation (SBBI) Yearbook™, Ibbotson Associates,Chicago (annually updated work by Roger G. Ibbotson and Rex A. Sinquefield). FTSE fixed income indices © 2024 FTSE Fixed Income LLC, all rights reserved. ICE BofA index data © 2024 ICE Data Indices, LLC. S&P data © 2024 S&P DowJones Indices LLC, a division of S&P Global. All rights reserved. Bloomberg data provided by Bloomberg.

Global Fixed Income

SECOND QUARTER 2024 YIELD CURVES

Interest rates generally increased across global developed markets for the quarter.

Realized term premiums were negative across global developed markets, as longer-term bonds generally underperformed shorter-term bonds.

In Germany and Canada, short-term interest rates decreased while longer-term interest rates generally increased. The short-term segment of the yield curve remained inverted in Australia, UK, Germany,and Canada.

US

UK

Germany

Japan

Canada

Australia

Changes In Yields (BPS) Since 12/31/2023

| Annualized | ||||||

|---|---|---|---|---|---|---|

| Country | 1Y | 5Y | 10Y | 20Y | 30Y | |

| US | 11.1 | 12.2 | 18.1 | 18.2 | 18.5 | |

| UK | 2.7 | 23.5 | 25.9 | 23.6 | 23.5 | |

| Germany | -15.0 | 13.2 | 19.0 | 21.9 | 22.3 | |

| Japan | 10.9 | 23.2 | 33.9 | 35.6 | 36.9 | |

| Canada | -28.4 | -0.8 | 4.5 | 4.4 | 3.6 | |

| Australia | 38.3 | 44.6 | 34.8 | 32.5 | 30.4 | |

One basis point (bps) equals 0.01%. Source: ICE BofA government yield. ICE BofA index data © 2024 ICE Data Indices, LLC.

Accessibility Statement

This website is run by R|W Investment Management. We strive to make our website as accessible as possible. If you would like to receive this content in a different way, please contact us toll-free at (844) 834-7500.