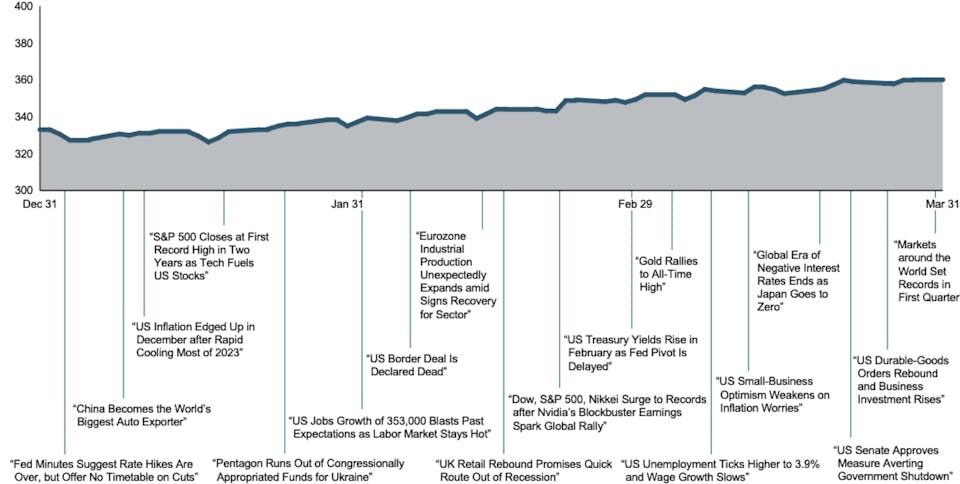

MSCI ALL COUNTRY WORLD INDEX WITH SELECTED HEADLINES FROM Q1 2024

TEXT DESCRIPTION

Presentation

Line chart with MSCI All Country World Index along the Y-axis with a range of 300 to 400, and dates along the X-axis ranging from December 31, 2023 to March 31, 2024. The chart shows the index increasing about 20 points over the time period and is annotated with newspaper headlines which are described under the next heading.

Data

January 2024

- Fed Minutes suggest rate hikes are over, but offer no timetable on cuts.

- China becomes the world's biggest auto exporter.

- US Inflation edged up in December after rapid cooling most of 2023.

- S&P 500 closes at first record high in two years as tech fuels US stocks.

- Pentagon runs out of congressionally appropriated funds for Ukraine.

February 2024

- US Jobs growth of 353,000 blasts past expectations as labor market stays hot.

- US border deal is declared dead.

- Eurozone industrial production unexpectedly expands amid signs recovery for sector.

- UK retail rebound promises quick route out of recession.

- Dow, S&P 500, Nikkei surge to records after Nvidia's blockbuster earnings spark global rally.

March 2024

- US Treasury yields rise in February as Fed pivot is delayed.

- Gold rallies to all-time high.

- US unemployment ticks higher to 3.9% and wage growth slows.

- US Small-business optimism weakens on inflation worries.

- Global era of negative interest rates ends as Japan goes to zero.

- US Senate approves measure averting government shutdown.

- US Durable-goods orders rebound and business investment rises.

- Markets around the world set records in first quarter.

Accessibility Statement

This website is run by R|W Investment Management. We strive to make our website as accessible as possible. If you would like to receive this content in a different way, please contact us toll-free at (844) 834-7500.